ny paid family leave tax opt out

An employee may file a waiver for PFL benefits if they. Reduction in Contribution Rate.

New York Paid Family Leave Shelterpoint

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

. If the FEIN on the policy is the correct legal FEIN and the FEIN on this notice is incorrect send a copy. Opting Out of Paid Family Leave 12 NYCRR 380-26 a An employee of a covered employer shall be provided the option to file a waiver of family leave benefits. Paid Family Leave provides a structure to help employees care for their families.

When practical employees should provide 30 days advance notice of their intention to use Paid Family Leave. Your employer will not automatically withhold taxes from these benefits. Paid Family Leave provides eligible employees job-protected paid time off to.

You will receive either Form 1099-G or Form 1099-MISC from your. If the FEIN on the policy is the correct legal FEIN and the FEIN on this notice is incorrect send a copy of your CP575 issued by the Internal revenue Service IRS to the New York State. You may request voluntary tax withholding.

There are a few limited scenarios under which certain employees may opt out by filling out the PFL-Waiver form. Seasonal may opt out of Paid Family Leave. New York Paid Family Leave is fully funded by employee payroll contributions.

New York State Paid Family Leave Program Reaches Maximum Benefits Level. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. I When his or her regular.

Starting with the new year the following changes will be going into effect with the PFL program. Work 20 hours per. To opt out you may complete a PFL waiver httpswww1nycgovassetsdcasdownloads pdfagenciespfl_waiver_nycpdf and submit it to your Human Resources HR representative.

Employees contribution rate is decreasing to 0455 with a.

Irs Answers Questions On Paid Family Leave Tax Credit

New York Paid Family Leave Lincoln Financial

Americans Could Finally Get Paid Family Leave But Who Pays Time

Is Paid Family Leave Taxable Employee Contributions Benefits

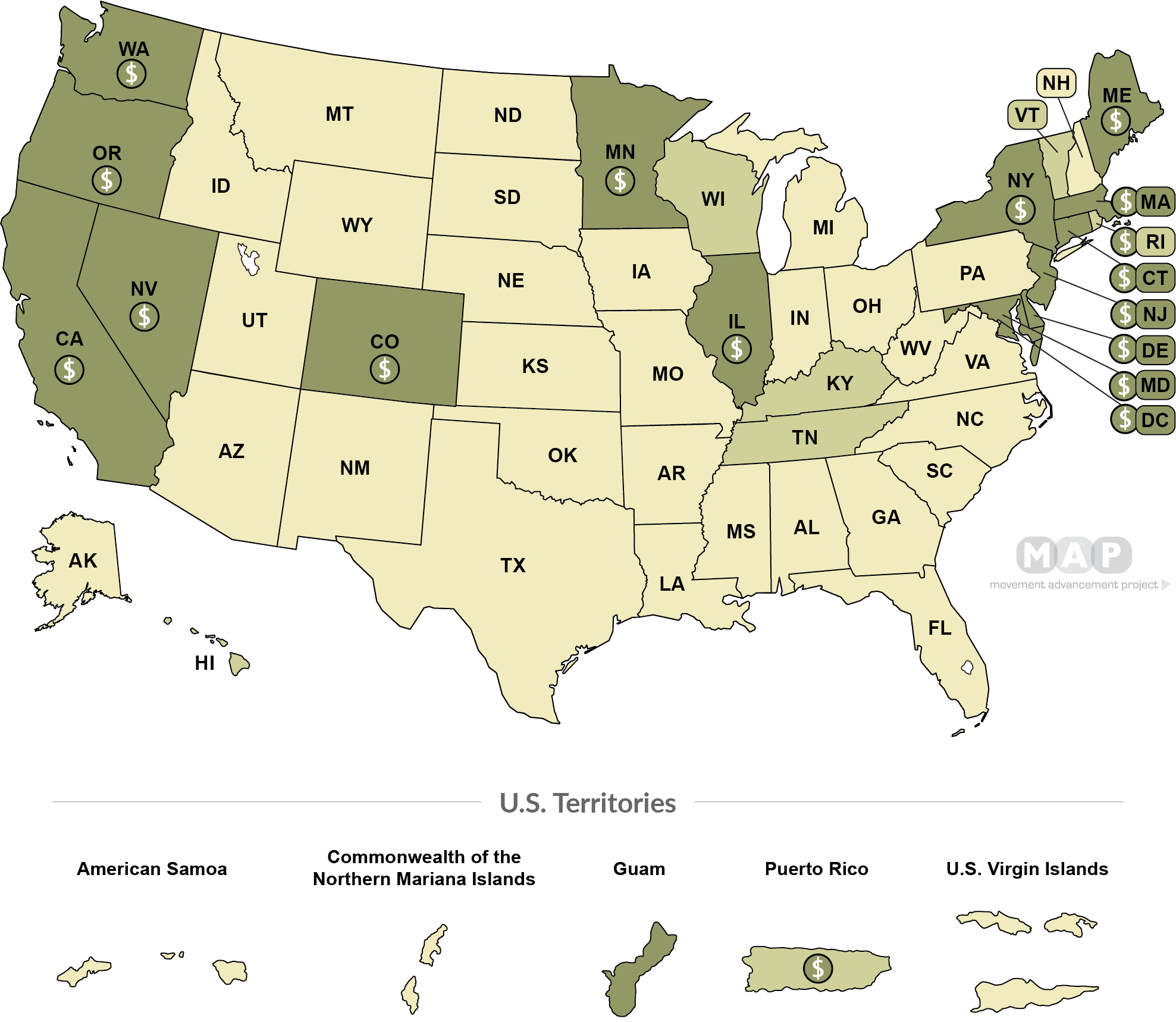

Movement Advancement Project Family Leave Laws

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

Get Ready For New York Paid Family Leave In 2021 Sequoia

/cdn.vox-cdn.com/uploads/chorus_asset/file/16005743/514657972.jpg.jpg)

Paid Family Leave There S A Bipartisan Push Brewing In The Senate Vox

Get Ready For New York Paid Family Leave In 2021 Sequoia

District Of Columbia Paid Family And Medical Leave Dc Pfml The Hartford

Paid Family And Medical Leave Benefits Are Available January 1 2021 What Massachusetts Employers Should Do To Prepare Blogs Labor Employment Law Perspectives Foley Lardner Llp

New York Paid Family Leave Resource Guide

New York Paid Family Leave An Employer Guide Ask Gusto

What Employers Need To Know About Washington S Paid Family Leave Law

What Are The States With Paid Family Leave Thorough Guide

What Are The States With Paid Family Leave Thorough Guide

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth